Cash rates

We had an interesting chat in our office regarding the recent interest rate cuts by National Savings & Investments (NS&I); the popular Income Bonds are going to pay 0.01% p.a. and Premium Bonds 1% p.a. From a taxpayer perspective (NS&I is a government department), the rate cuts were well overdue as the relatively high rates offered by the Treasury were out of sync with the non-government backed commercial banks and gilts. From a savers perspective it’s a disaster. It’s also a disaster from an equality perspective and will highlight the advice gap that is fuelling inequality between owners of capital and those that remain invested in cash. I genuinely believe that having high allocations to cash is going to ruin real wealth over the next decade.

If you have access to advisers, take their advice on cash. Cash is undoubtedly a sensible holding for emergency funds or short-term saving needs. However, if your savings are intended for a time-period of over five years, I would implore you to invest it. It will mean putting your capital at risk, however cash is not risk-free and investing is just taking different sorts of risk. I can’t guarantee that the invested portfolio will generate returns above inflation over the next five years, however I can pretty much guarantee that your cash savings will reduce your real wealth every year for the next five years. All of the commentary from central banks are pointing to a relaxed attitude towards higher levels of inflation (such as the US Federal Reserve’s move to inflation averaging), which will eat away at debt levels but also eat away at the real wealth of cash savings.

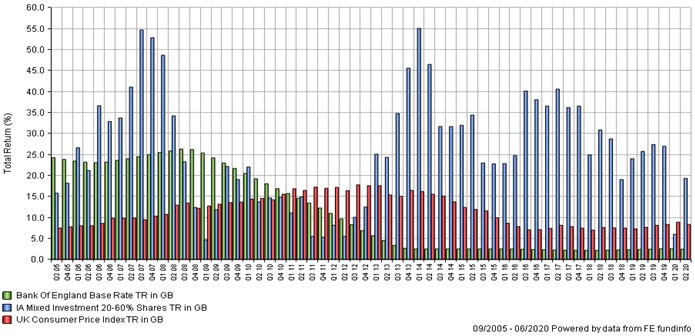

The below chart looks at the returns generated from the Investment Association’s (IA) Mixed Investment 20-60% Shares sector (in blue) versus the Consumer Price Index (CPI, in red), which is the UK’s preferred method of measuring inflation and the Bank of England’s Bank Rate (in green), which is a proxy for returns from cash. The IA sector includes funds that have between 20% and 60% in equity markets and is commonly referred to as the ‘Cautious’ sector. The chart shows the total return from the average fund performance in the sector over a rolling five year period on a quarterly basis compared to CPI and the Bank Rate over the same time period. The worst return from the ‘Cautious’ sector was investing in Q1 2004 to Q1 2009, which would have generated a return just short of 5%.

My point is that if you have the ability to put the capital at risk, time is your friend and investing your assets will provide you with a much higher probability of maintaining or increasing your real wealth.

The below chart shows that you can achieve this even if you have a ‘Cautious’ risk profile. The impact of the cuts in interest rates following the financial crisis means that cash investors have lost real wealth every year since.

Those with fewer assets may miss out on advice and be subject to seeing their real wealth fall over the next few years and the fall in rates at the NS&I will just make this worse. Most cash interest rates offered by banks are already close to zero and those that aren’t are starting to fall, such as Marcus by Goldman Sachs’ announcement to cut their interest rate this morning.

Thanks for reading.